Why Multiple Tax Options Matter in Business Invoicing

For businesses of all sizes, accurate invoicing is essential. But when taxes enter the equation, things get more complicated — fast. Whether you’re operating locally, selling to different regions, or handling various service types, one thing becomes clear: having multiple tax options in your invoicing software isn’t just convenient — it’s critical.

In this article, we’ll explore why multiple tax options are necessary for modern billing, how they help ensure legal compliance, and how LaskuTasku makes managing different tax rates easy, flexible, and efficient.

The Realities of Tax in Invoicing

Every product or service sold may be subject to a different tax treatment depending on:

- The country or region of the buyer

- The type of product or service

- Exemptions (e.g. zero-rated or reverse charge VAT)

- Whether the buyer is a business or consumer

If your invoicing system doesn’t support multiple tax options, you’re likely to:

- Manually calculate and enter tax each time

- Risk using the wrong rate

- Generate non-compliant invoices

- Confuse your clients

What Are Multiple Tax Options?

In short, multiple tax options let you apply different tax rates to different items, clients, or countries — all within the same invoicing system.

For example:

- 24% VAT for standard services in Finland

- 0% VAT for intra-EU B2B sales

- 10% reduced rate for certain products

- Tax-exempt clients (e.g. NGOs or educational institutions)

With a tool like LaskuTasku, selecting the correct rate becomes a simple dropdown, not a manual headache.

Why It Matters: Key Benefits of Multiple Tax Options

1. ✅ Legal Compliance

If you apply the wrong tax rate, your invoice may be legally invalid. Worse, you might:

- Underpay your taxes and face penalties

- Overcharge clients and damage trust

- Get flagged in audits

Multiple tax options help you stay compliant with national and EU-wide tax rules.

2. 🔍 Transparency for Clients

Your clients expect clarity. Listing tax amounts and rates directly on the invoice builds trust and avoids confusion. With LaskuTasku:

- The correct VAT percentage appears on each item

- The total tax amount is calculated automatically

- Invoices clearly display “No VAT” when needed

3. 💼 Flexible for Different Business Types

Maybe you sell services and products. Maybe you work with both private customers and EU companies. Maybe you offer some tax-free consulting hours.

Whatever the case, your invoicing software must allow:

- Mixed tax rates in one invoice

- Tax-exempt line items

- Custom tax names and percentages

LaskuTasku gives you full control — whether you’re a sole trader or a growing team.

4. 📊 Accurate Reporting and Bookkeeping

Correct taxes = correct reports.

Your accountant (or tax software) will thank you when:

- Each invoice is tagged with the proper VAT

- Reports break down sales by tax category

- Annual summaries match your tax declarations

With multiple tax options, LaskuTasku ensures every invoice feeds into clean, audit-ready data.

5. 🌍 International Sales Made Simple

Selling outside Finland? You may be required to:

- Apply 0% VAT for reverse-charge sales

- Add your VAT ID and that of your client

- Format your invoice per EU cross-border rules

LaskuTasku makes it easy by:

- Allowing selection of “EU B2B – 0% VAT”

- Automatically formatting the invoice correctly

- Keeping your business tax-compliant across borders

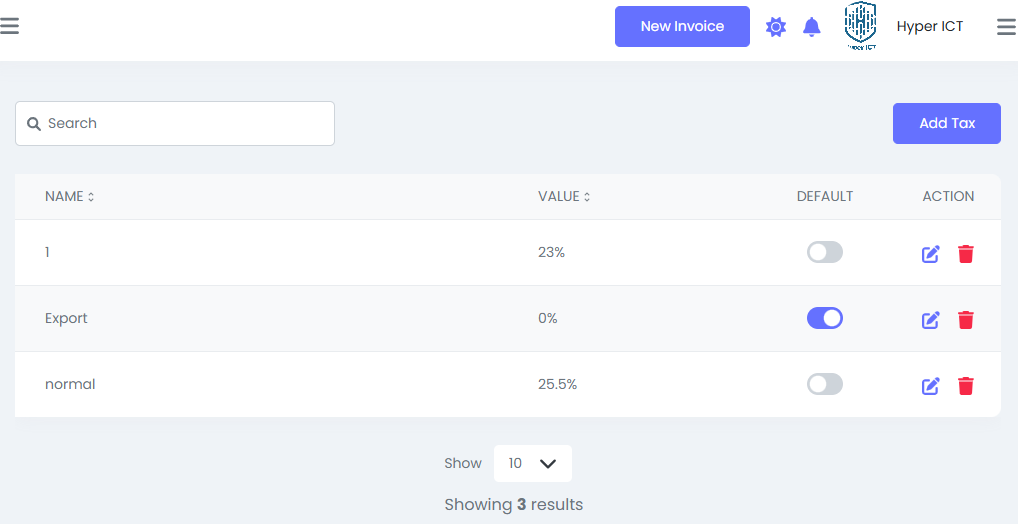

How LaskuTasku Helps

LaskuTasku is built for small business flexibility. That includes full support for multiple tax options at no extra cost.

With LaskuTasku, you can:

- Define your own tax rates (e.g. 24%, 14%, 0%)

- Apply different rates to different items in one invoice

- Add tax-exempt lines easily

- Store tax settings for each client

- Include tax notes or regulatory text when needed

And yes — it’s available even in our free invoicing plan.

Real Business Use Cases

👨🍳 A Catering Company

Sells food at 14% VAT and services at 24%. Needs both in one invoice.

👩💻 A Software Consultant

Bills local clients with 24% VAT, but charges 0% for EU-based B2B clients.

👨🏫 A Trainer

Provides educational services that are VAT-exempt. Also sells materials with 10% VAT.

Each case demands multiple tax options — not workarounds.

What Happens Without Tax Flexibility?

Without support for multiple tax options, you might:

- Manually calculate taxes — and risk errors

- Create multiple invoices for different tax cases — wasting time

- Confuse clients with vague tax lines

- Miss VAT rules — leading to audits or fines

With LaskuTasku, everything is automated, visible, and auditable.

Turbo Plan = Even More Control

Our Turbo Plan (€120/year) unlocks:

- Unlimited invoicing

- Priority support

- Advanced reporting by tax category

- Editable invoice templates with custom tax layouts

It’s ideal if you:

- Operate in multiple sectors

- Sell internationally

- Have complex tax profiles

But even the free plan covers the most common tax needs for freelancers and small businesses.

What Our Users Say

“I work with Finnish and EU clients. Having 0% and 24% VAT on the same platform is a game changer.”

— Emilia K., Marketing Consultant

“Before LaskuTasku, I had to send two separate invoices for mixed tax cases. Now I can do it in one step.”

— Teemu V., Product Designer

“It’s simple, accurate, and fully supports Finnish tax rules. No more Excel nightmares.”

— Sanna L., Workshop Organizer

Conclusion: Smart Invoicing Needs Smart Tax Logic

If your business deals with more than one kind of tax, you need tools that can keep up. LaskuTasku’s support for multiple tax options makes your life easier, your invoices clearer, and your operations compliant.

Whether you charge 24%, 10%, or nothing at all — we’ve got you covered.

Start Invoicing With Smart Tax Options Today

Try LaskuTasku for free at laskutasku.fi and experience what it’s like to handle taxes the right way — with clarity, speed, and confidence.